#35 RBI opens liquidity flood gates and A growing wealth management stock

2nd June'25 - 6th June'25

Welcome to this week’s newsletter, grab a cup of coffee and let me show you last week’s highlights related to Indian market. If you haven’t subscribed, please use the `Subscribe` button below and get my newsletters every Sunday morning directly in your email

Thank you and let’s get started.!!

`Market rewards the one with patience, build your wealth slow and steadily`

Markets and Macros

Another good week for Indian Stock market, most of the indices gave positive return over the last week with Defence and Metal stocks leading the pack.

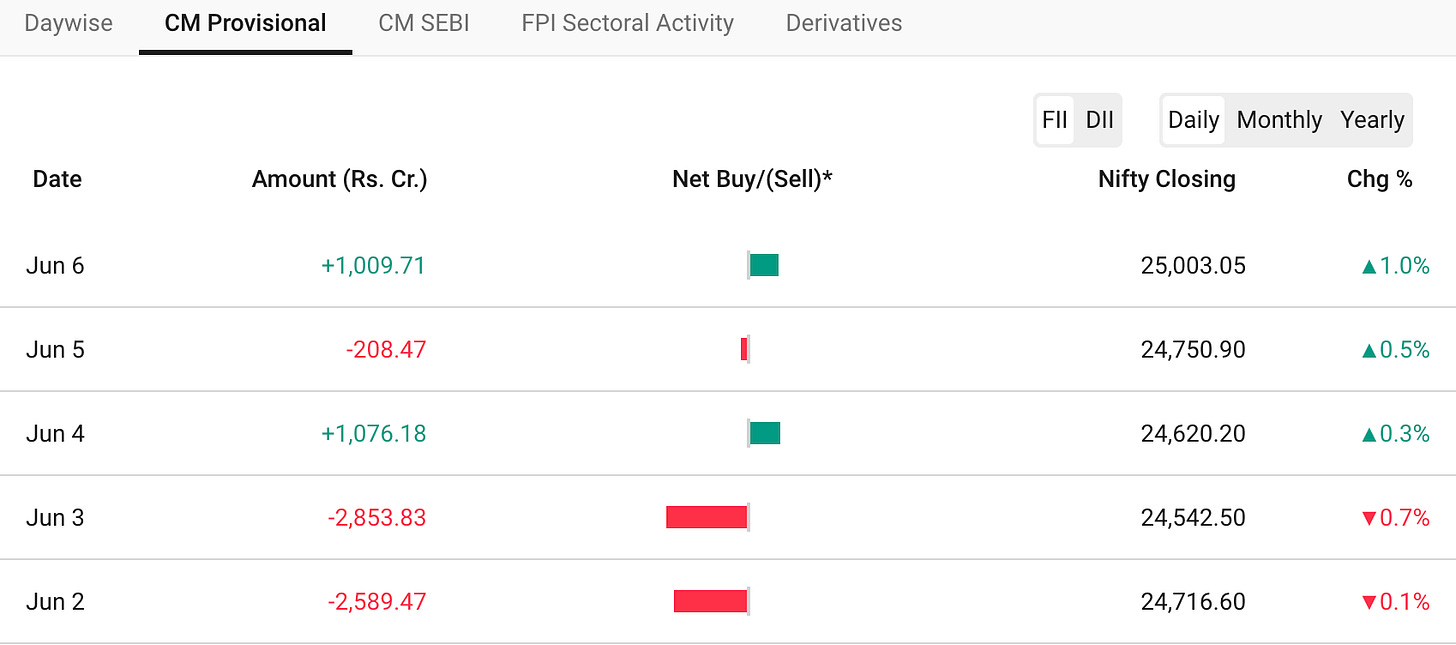

FII Activity this week

DII Activity this week

Strong DII buying this week, which i expect is by the mutual fund houses which were sitting on high cash during the crash.

RBI has now shot a bazuka by cutting interest rates by 0.50%. Hence, the interest rates from RBI is now 5.5%. This happened when inflation is at its all time low in the market, which gave RBI space to cut the rates.

RBI has also reduced the CRR (Credit Reserve Ratio) which is basically how much % of money each and every Bank has to keep with RBI in order to function well. Now when CRR is reduced, Banks can now keep some more cash with themselves and provide loans easily.

The combo of cuts in CRRs and repo rate would bring a consumption boost in the Indian market and spending of Indian consumer would improve considerably.

Don’t forget that from this year onwards, Indian Government has also moved the income tax bracket. People earning upto 12 LPA need not pay any income tax which is a big thing.

The auto sector might be facing some headwinds, China has limited its supply of rare earth metals which is a key component in auto manufacturing. Recently, BYD a China based automotive company has announced major discount on its vehicles.

Indian government has taken steps to counter this rare earth metals situation and request private companies to start surveying and supplying rare earth metals, Government have also included this initiative in the PLI scheme.

Elon Musk and Donald Trump recently got into a verbal fight, when the issue of increasing debt on the US economy came up. The US economy is basically in trillions of debt and the present government is not doing anything to reduce it. Tesla corrected big time during this fights as Donald Trump threatened to cut Musk’s government contracts.

Stock of the week : Cholamandalam Finance

Cholamandalam Investment and Finance Company Ltd (Chola), part of the Murugappa Group, has established itself as a significant player in India's non-banking financial company (NBFC) sector. Known for its prudent lending practices and conservative approach, Chola has consistently demonstrated resilience and growth in a competitive market.

Understanding Chola's Lending Approach

Chola primarily focuses on financing income-generating assets, such as commercial vehicles, tractors, and machinery. This strategy ensures that loans are backed by assets that either retain or appreciate in value, thereby reducing the risk of defaults. The company's emphasis on collateral-backed lending has contributed to its relatively low non-performing assets (NPAs) compared to peers.

In contrast to NBFCs that concentrate on consumption-based lending—like financing electronics or personal loans—Chola's approach is more aligned with supporting productive economic activities. This distinction positions the company to better withstand economic cycles, as income-generating assets often maintain their utility and value even during downturns.

Conservative Growth and Capital Management

A hallmark of Chola's strategy is its conservative capital management. The company has historically relied on internal accruals to fund expansion, avoiding frequent equity dilution. This approach not only preserves shareholder value but also reflects management's confidence in sustainable, organic growth.

The Murugappa Group's long-standing history spanning over a century underscores its commitment to stability and long-term value creation.

Financial Performance and Market Position

Chola's financial metrics highlight its robust performance. As of the latest data, the company's stock is trading at approximately ₹1,593.20, while its intrinsic value is estimated at ₹2,141.73, suggesting potential undervaluation . Over the past five years, Chola's stock has appreciated by nearly 994%, reflecting strong investor confidence and consistent growth.

In the fiscal year 2023, Chola reported a 24% year-on-year increase in profit, amounting to ₹853 crore . This performance underscores the company's effective business model and its ability to capitalize on opportunities within its niche.

Financial Valuations

Step 1: Book Value per Share (BVPS)

From Mar 2025 data:

Equity Capital = ₹168 Cr

Reserves = ₹23,500 Cr

Total Equity = ₹23,668 Cr

Number of Shares = 168 Cr

📘 BVPS = 23,668 / 168 = ₹140.88

Step 2: P/BV (Price to Book Value)

Market Price = ₹1,593

📊 P/BV = 1,593 / 140.88 = 11.31×

Step 3: P/E Ratio

EPS FY25 = ₹50.69

📊 P/E = 1,593 / 50.69 = 31.42×

Step 4: Fair P/BV Estimate (using RoE & P/E)

Using RoE = 20%,

Fair P/BV ≈ (RoE × P/E) / 100

= (20 × 31.42) / 100 = 6.28×

Valuation Summary

Metric Value

BVPS ₹140.88

P/BV 11.31

EPS (FY25) ₹50.69

P/E 31.42

RoE 20%

Fair P/BV ~6.28×

Actual P/BV is higher than estimated fair P/BV.

This suggests the stock may be overvalued at the current price unless you expect RoE or growth rates to materially accelerate.

Full disclosure, I personally hold a position in Cholamandalam Finance and do not recommend you to buy or sell.

Watchlist

A lot of news has been buzzing around the rare earth metals/minerals. But what exactly are they. Have a look at the below video to understand it in a better way.

Thank you for all your attention till this point.

Feel free to share this newsletter with someone who is into stocks :)